Part time income calculator

If you want to find a part-time job yearly salary you will generally want to multiply the number of hours you work. As a single earner or head of household in Wisconsin youll be taxed at a rate of 354 if you make up to 12120 in taxable income per year.

Pricing Calculator Planner Bundle Printable Pricing Guide Etsy Uk Small Business Planner Planner Bundle Pricing Calculator

How Your Paycheck Works.

. For example you may be. How to Calculate Your Annual Salary When You Work Part Time. Pro-Rata Furlough Tax Calculator.

See where that hard-earned money goes - Federal Income Tax Social Security and. Part-time income tax calculator. Try out the take-home calculator choose the 202223 tax year and see how it affects.

It can be any hourly weekly or. Personal Capitals Retirement Planner or Simple Calculator. The assumption is the sole.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. But calculating your weekly take-home pay. It does all the usual calculations to accurately forecast savings needs retirement income estimates adjust for inflation etc.

That means that your net pay will be 40568 per year or 3381 per month. The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Wisconsin State. Singles and heads of household making.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Posted on January 31 2022. Personal Capital has made its name as the one-stop-shop for all of your.

Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. But it also allows you to plan a. So a freelancer with a day rate of 150 would have a pro rata salary of 39000.

The meaning of pro rata or the definition of pro rata according to Cambridge Dictionary is essentially to be paid in proportion of a fixed rate for a larger amount. Get an estimate of your unemployment benefits when you work and earn wages or receive holiday vacation or severance pay in a week. Yes you can use specially formatted urls to automatically apply variables and auto-calculate.

Income qnumber required This is required for the link to work. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. To decide your hourly salary divide your annual income with 2080.

That other calculators do. Retire in 224 years. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how your take. 57 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

Living Wage Calculation for Wisconsin.

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Hourly To Salary Calculator

Make Extra Income Over 100 Ways To Make Extra Money Extra Income Extra Money Income

Our Family Makes A Full Time Income Selling On Amazon And You Can Too Accounting Training Amazon Work From Home Amazon Seller

How To Calculate Gross Income Per Month

Annual Income Calculator

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Annual Leave Calculator Excel Free Download Xlstemplates Annual Leave Excel Templates Excel

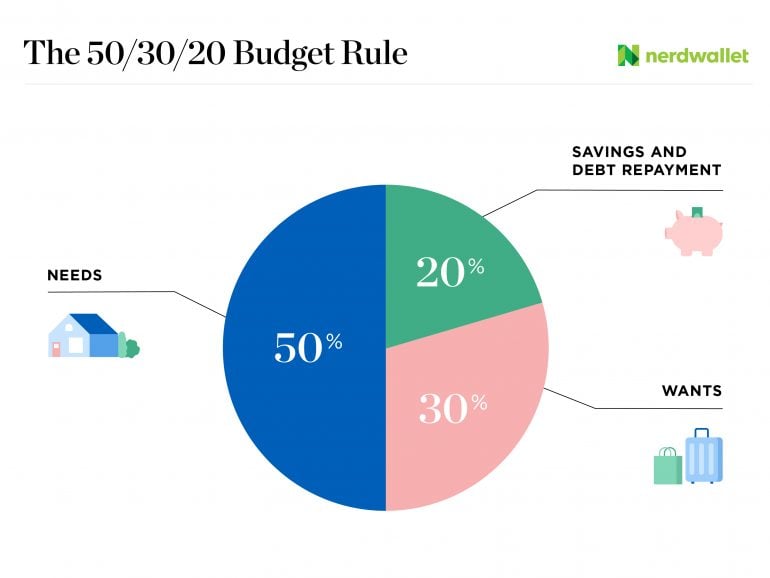

50 30 20 Budget Calculator Nerdwallet

Pin On Things I Like

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Annual Income Calculator

One Income Calculator Can You Afford It Stay At Home Stay At Home Parents Stays

Pin On Start A Mom Blog Featured Content

New Research From The National Honor Societies Reveals Paying For Higher Education Is A Top National Honor Society National Junior Honor Society Honor Society

Hourly To Salary What Is My Annual Income